Hi everyone, below I would like to share my August expiration M3 position.

June 23rd: I put on the position at 56 days to expiration as recommended for the position. Since the market was at 1415, I centered the butterflies at 1390 with 50-point wingspans as usual. I bought a 1280 call to offset the negative Delta which resulted in the position starting with -4.5 Delta.

Below is the risk profile graph of the starting position:

June 28th: Today, because of the massive upswing of the market (more than 20 points), I had to move half of my butterflies up to 1410. With this adjustment, I was able to increase the Theta value and decrease the Vega value of the position, as well as make the Delta less negative. The position is currently down $242.

July 6th: The large upswing from the last adjustment was matched by a downswing of almost 20 points in the market today. As a result, I moved all of my previously adjusted butterflies (at 1410) back to their original position of 1390. Although this move wasn't particularly beneficial to the Greek values of the position, it allowed for greater coverage of the market inside the tent of the butterfly. The position is currently profitable at $338.

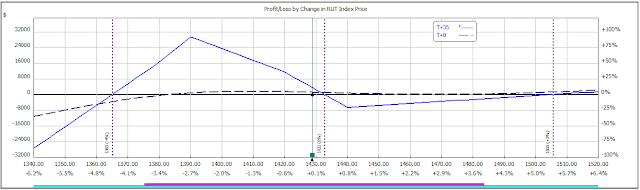

Below is the risk profile graph of the position on July 6th:

July 10th: As a result of a 7-point drop, I had to add two 1380/1390 verticals. The Delta value of the position was approaching the negative limit of -50 so the verticals brought some positive Delta to offset that. The addition also increased the Theta value and decreased the Vega value of the position. The position is currently profitable at $1,126.

July 12th: After two days and a total of 15 points up for the market, the negative Delta value rose to -67, which is higher than the limit. This caused the addition of 3 1390/1410 verticals. Although I didn't necessarily need to add all three of the verticals to return the position back to within the limits, I wanted the flatten out the t + 0 line in front of the tent. This could be beneficial in the future since the market has been almost constantly bullish. The position is currently profitable at $925.

July 14th: After two more days of the upward market movement, the Delta was more negative than I wanted again. I ended up adding three 1410/1420 verticals to fix this. This adjustment also helped me flatten out the t + 0 line of my position. Flattening out the t + 0 line is essentially moving the risk to the back end of the butterfly from the front end. By adding these verticals, you can actually see the form of the butterfly shift and the line made from the call actually moves up and starts coming towards the $0 line.

Below is the risk profile graph of the position on the 14th. Notice how the position is shaped differently than the last profile in the post.

July 17th: I added one 1390/1420 vertical because the negative Delta of the position has exceeded -50 again. This adjustment brought the total Delta value to -36.5 and increased the Theta of the position.

July 18th: I added another 1390/1420 vertical to increase the Theta value and continue to flatten the t + 0 line. The Delta had not exceeded the negative limit, but this adjustment made the value less negative (keeping it in check).

Below is the risk profile graph of the position on July 18th. Notice how the call portion of the position has risen even more because of the verticals added over the past two days.

July 20th: Today, because of the 15 point move of from the market over the past two days, I decided to move half of my butterflies up to 1410. The market was outside of the tent (a little too much for comfort) and the Theta of the position was also low. After this adjustment, the negative Delta was beyond its -50 limit, so I added another 1390/1420 vertical to correct it. The position is profitable at $827.

Below is the risk profile graph of the position on July 20th:

July 24th: Today, I added another two 1390/1420 verticals because of the Delta value of -75 (outside of limits). This adjustment increased the Theta and decreased the Vega values of the position. The position is currently profitable at $1,563.

Below is the risk profile graph of the position on July 24th:

Stay posted to see what happens to my August position!

Hey there..excellent trading. Have you been successful trading this system?

ReplyDeleteHi! I have been successful trading this system over the past two years. It is important to note however, that all of my positions are simulated and do not reflect the challenges of executing positions in the market and the price fluctuations that occur with that. Thank you for reading the blog, and I hope you will continue to do so in the future!

DeleteThank you for your posts. They are very informative.

ReplyDeleteI'm glad that they were helpful for you. Thank you for letting me know!

Deletehi prachi , m from India , just want to know that what is margin requirement for a butterfly/or bearish butterfly in USA , like for example balanced butterfly with maximum loss of 1000 dollars and max profit of 4000 dollars (1:4 risk reward for bearish butterfly) , do they charge only max loss as margin , because i was trying to trade m3 on nifty in India, so for such a butterfly with maximum loss of rs 10000 and maximum profit of rupees 40000 , SPAN margin for NSE(nation stock exchange of INDIA)is whopping 50000 to 60000, which will drastically reduce your return on capital , also i want to know how m3 annual return of 60 to 70 % is calculated like for that for dollar 50k account do you use all capital or you use only part of capital and keep rest as reserve.

ReplyDeleteHello. The annual return percentage is calculated using the entire 50k account even if all of the capital is not being used in the position. In regard to your first question, I want you to be very careful putting in your own money using this system. I use John Locke's M3 system and the guidelines for the Greeks that he has found for the Russell 2000 and SPX. These Greek values, however, will differ greatly with the Nifty, so you should thoroughly backtest the strategy and have a clear understanding of the Greeks and Greek trends within the position. For example, a butterfly on the Nifty would definitely have to have a larger wing width than the 50 points we use on the Russell. There is no margin requirement for a balanced butterfly in the USA (the capital requirement is all that is needed).

DeleteHI prachi,

ReplyDeletesecond question is regarding adjustment done on july 10 , 14 etc you say i added vertical to offset negative delta , that means you added extra lots of put credit spread , making butterfly uneven like orignal butterly composed of 10 debit and 10 credit spreads equally placed (10-20-10 balanced bearish butterfly), now to offset negative delta you add 3 verticals , i guess you want to say you added 3 extra credits spreads , tell me if I m right.

Also please guide to you selected strikes and number , as delta can be corrected by many combinations of strike and number.

thanks

Hello. I always use call credit spreads when I add verticals, not put credit spreads. Doing this allows me to keep my butterfly structure intact and makes the position easier to manage. If I were to use put credit spreads, the Greeks would not differ, but the position would be much more complex. The selected strikes for the vertical positions can be found in the post (the numbers 1390/1410 refer to the strikes of the verticals).

Delete