Hello everyone. Below I would like to share my January expiration M3 position.

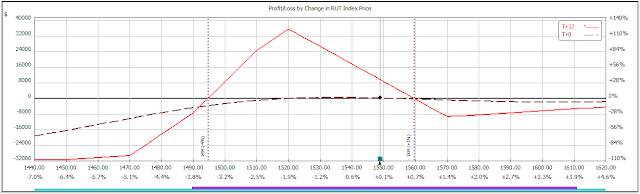

November 24th: On Friday, 56 DTE like all the positions I put on, I started my position. Since the market was at 1519, I centered my butterflies at 1490. This is because of the guideline with M3 positions that the butterflies should be placed 20-30 points below the market. The butterflies had 50-point wingspans as usual. In order to offset the negative Delta, I bought a 1450 call.

The risk profile graph of the beginning position can be seen below:

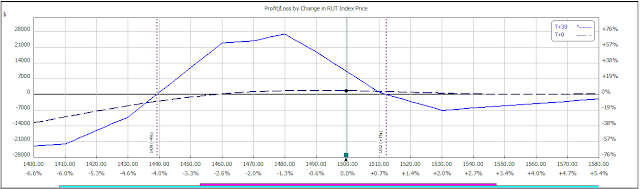

November 29th: After five days in the position, the market had come up almost 25 points and was level with the upper wing of the butterfly. Also, the Vega was almost positive and the Theta was very low. To correct this, I moved half of the butterflies up to the 1510 strike price. Doing this allowed me to have a higher negative Vega value and brought the tent of my butterflies closer to the market.

The risk profile graph of the updated position can be seen below:

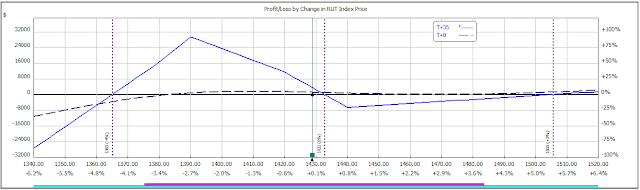

December 6th: Within a week, the market had reversed and came all the way down to 1509, even lower than when the position was put on. Although the Theta and Vega values were within their limits, the Delta had become greatly positive. To fix this, I moved my butterflies back to 1490. At this time, the positive was up $625.

December 11th: A few days later, with the market at 1520, the Delta of the position was greater (more negative) than -50. To combat this, I added a four 1490/1510 verticals. I did not need four verticals to correct the Delta value; however, I wanted the t + 0 line to be as flat as possible in front of the tent.

The risk profile graph of the updated position can be seen below:

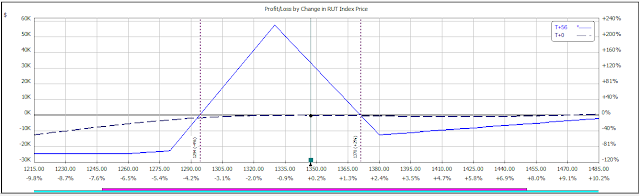

December 14/15th: On the 14th, the Delta of the position was again too positive, so I took off one of the verticals I had previously placed. This corrected the Delta and brought the Delta value close to 0. On the 15th, after the market rallied almost 25 points in one day, the t + 0 line became very uneven and the Delta value became very negative (though not -50). To fix the t + 0 line, I added two additional 1490/1510 verticals (there are now 5).

The risk profile graph after both updates can be seen below:

December 18th: The market had rallied to almost 1550, and the Theta and Vega values were very low. Also, the market was about ten points above the upper wing. To correct this, I had to move all of the butterflies up to 1520. This allowed me to have a Theta value of 130 and a Vega value of -626.

The risk profile graph of the updated position can be seen below:

December 19th: I took the position off for a $1,117 profit.