Hi everyone, below I would like to share my August expiration M3 position.

June 23rd: I put on the position at 56 days to expiration as recommended for the position. Since the market was at 1415, I centered the butterflies at 1390 with 50-point wingspans as usual. I bought a 1280 call to offset the negative Delta which resulted in the position starting with -4.5 Delta.

Below is the risk profile graph of the starting position:

June 28th: Today, because of the massive upswing of the market (more than 20 points), I had to move half of my butterflies up to 1410. With this adjustment, I was able to increase the Theta value and decrease the Vega value of the position, as well as make the Delta less negative. The position is currently down $242.

July 6th: The large upswing from the last adjustment was matched by a downswing of almost 20 points in the market today. As a result, I moved all of my previously adjusted butterflies (at 1410) back to their original position of 1390. Although this move wasn't particularly beneficial to the Greek values of the position, it allowed for greater coverage of the market inside the tent of the butterfly. The position is currently profitable at $338.

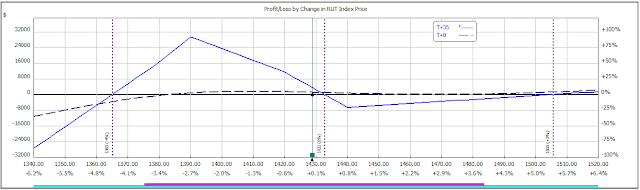

Below is the risk profile graph of the position on July 6th:

July 10th: As a result of a 7-point drop, I had to add two 1380/1390 verticals. The Delta value of the position was approaching the negative limit of -50 so the verticals brought some positive Delta to offset that. The addition also increased the Theta value and decreased the Vega value of the position. The position is currently profitable at $1,126.

July 12th: After two days and a total of 15 points up for the market, the negative Delta value rose to -67, which is higher than the limit. This caused the addition of 3 1390/1410 verticals. Although I didn't necessarily need to add all three of the verticals to return the position back to within the limits, I wanted the flatten out the t + 0 line in front of the tent. This could be beneficial in the future since the market has been almost constantly bullish. The position is currently profitable at $925.

July 14th: After two more days of the upward market movement, the Delta was more negative than I wanted again. I ended up adding three 1410/1420 verticals to fix this. This adjustment also helped me flatten out the t + 0 line of my position. Flattening out the t + 0 line is essentially moving the risk to the back end of the butterfly from the front end. By adding these verticals, you can actually see the form of the butterfly shift and the line made from the call actually moves up and starts coming towards the $0 line.

Below is the risk profile graph of the position on the 14th. Notice how the position is shaped differently than the last profile in the post.

July 17th: I added one 1390/1420 vertical because the negative Delta of the position has exceeded -50 again. This adjustment brought the total Delta value to -36.5 and increased the Theta of the position.

July 18th: I added another 1390/1420 vertical to increase the Theta value and continue to flatten the t + 0 line. The Delta had not exceeded the negative limit, but this adjustment made the value less negative (keeping it in check).

Below is the risk profile graph of the position on July 18th. Notice how the call portion of the position has risen even more because of the verticals added over the past two days.

July 20th: Today, because of the 15 point move of from the market over the past two days, I decided to move half of my butterflies up to 1410. The market was outside of the tent (a little too much for comfort) and the Theta of the position was also low. After this adjustment, the negative Delta was beyond its -50 limit, so I added another 1390/1420 vertical to correct it. The position is profitable at $827.

Below is the risk profile graph of the position on July 20th:

July 24th: Today, I added another two 1390/1420 verticals because of the Delta value of -75 (outside of limits). This adjustment increased the Theta and decreased the Vega values of the position. The position is currently profitable at $1,563.

Below is the risk profile graph of the position on July 24th:

Stay posted to see what happens to my August position!