On this blog, I will be displaying constant updates of my simulated and backtested trades.

Monday, August 15, 2016

Adjusting the September

After having the September position on for a few weeks, I have had to make a few adjustments:

August 5th: I had to add two of the 1200/1220 verticals in order to reduce the negative Delta of the position. The market was sitting outside of the tent so I had to adjust the position to have less than -50 Delta.

August 8th: The position had too much negative Delta again so I had to add the 1200/1210 vertical in order to correct it. With the addition of this vertical, the positive Theta and the negative Vega both increased. On this date, the position was up $545.

August 12th: With the negative Delta reaching -55, I had to add the 1200/1220 vertical to the position. Adding this vertical reduced the negative Delta of the position from -54 to -40. The position is currently up $441.

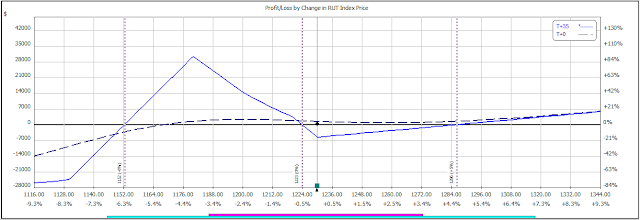

The current risk profile graph looks like this:

Stay tuned over the next few weeks as a keep adjusting my September position!

Wednesday, August 3, 2016

Closing the August Position

Over the past few days, I have made a series of adjustments to my August position. All of the adjustments I have made were as a result of too much negative Delta. On July 27, July 28, and August 1, I added the vertical 1170/1200 to reduce the negative Delta value of the position (they were at -61, -67, and -60 respectively). The market had been outside of the tent for all of these adjustments. I decided to take the position off yesterday, August 2 with a profit of $1,018. With only 16 days left until expiration, I thought that I should take the profit -which has not been over $1,000 for the position- while I could.

The final risk profile graph of the August 2016 position can be seen below:

The September position is currently at a $479 profit and no adjustments have been needed for this position over the past few days. The September position still has 44 days until expiration.

This is what the September position's current risk profile graph looks like:

Subscribe to:

Posts (Atom)