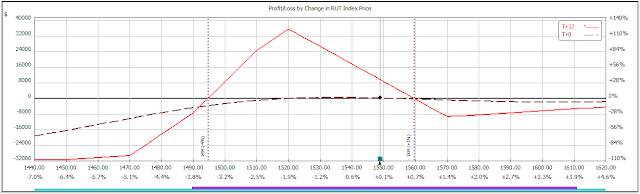

November 23: I put on my M3 on Friday, 56 DTE like all positions. Since the market was at 1488, I placed my butterflies at 1460. Because of market pricing, I had to buy 24 butterflies instead of 10 to have a Delta value of -100. In order to offset the negative Delta, I bought a 1270 call to bring the total Delta to -5.

The risk profile graph of the initial position can be seen below:

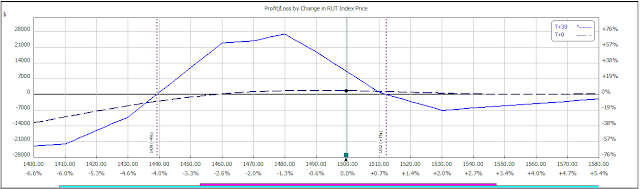

November 29: The following Thursday, the negative Delta of the position exceeded -50, so I added two 1480/1500 verticals to make the Delta more positive. Adding the two verticals also helped flatten out the t + 0 line and moved some of the risk from the front to the back of the tent of the butterflies. With the adjustment, the Greeks are as follows: Delta -26, Theta 79, and Vega -234.

December 3: I had to move my position up the following Monday because the market was 30 points above my long strikes. I had refrained from moving them up earlier because my Vega was still negative, but because my Theta was so low I moved the butterflies up to 1510. This is was 35 points below the current market price. When moving my butterflies up, I sold two butterflies because my Delta exceeded -50 with the adjusted position. The Greeks for the updated position are Delta -42, Theta 147, and Vega -649.

The risk profile graph of the adjusted position can be seen below:

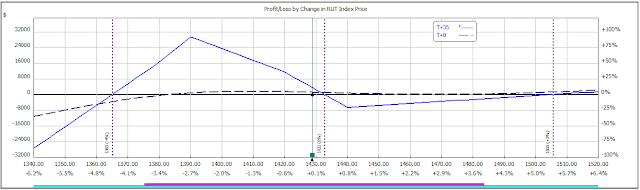

December 4: I had to move my butterflies again the next day because the market had dropped so much over the past few days (it was below my shorts) and the Delta was above the positive 50 limit for the position. I placed the new butterflies at 1450, a little more than 30 points below the market at 1483. The Greeks for the updated position are Delta -18, Theta 141, and Vega -522.

The risk profile graph of the position can be seen below:

December 10: I had to move my butterflies even further down because the Delta of the position exceeded 50 after the market had moved down more. I moved the butterflies from 1450 to 1420, about 20 points below the market. The Greeks for the updated position are Delta 9, Theta 151, and Vega -483.

The risk profile graph of the position can be seen below:

I will try and update as often as possible in the new year. I hope you continue to follow the blog as I close the January position and continue trading in 2019!