Hello, everyone. I know I haven't updated my blog in a long time but I am hoping to get back into the swing of things and update as regularly as I can.

The position seen below is an M3 with a January expiration that I had been trading in the past two months.

11/25 - I bought 15 butterflies at 1330. This is different than the usual 10 butterflies that the M3 position suggests but because 10 butterflies were not giving enough negative Delta, I had to buy 15. The call I bought was at 1260 with a positive 81 Delta value to bring overall delta to a little under -5 like the position is supposed to.

This is the risk profile graph at the start of the position:

12/1 - Today, I am closing position with a $1,440 profit. Because I made so much return in only a week, I decided to take the position out but put on another position on the same day because there is still 50 days until expiration for January. This new position has 14 butterflies at 1290 and a call at 1110.

Here is the risk profile graph of the new position:

12/6 - I bought two 1310/1330 verticals even though the Delta value did not exceed -50. Buying these verticals allowed me to raise the t

12/7 - The Vega value of the position became positive after the market moved higher than the upper wing of the butterfly. In order to correct this, I moved entire position to 1340 and added another butterfly to make 15 total and have a position Delta value of -6.

12/16 - I added two 1330/1340 verticals to flatten out t + 0 line (like before). The position is currently at a profit of $1,158.

This is what the risk profile graph from 12/16 looks like:

12/17 - I added two 1310/1350 verticals because the position's Delta value was at -80. Adding these verticals made it -43 which is within the -50 Delta value limit. This also helped flatten the t + 0 line.

12/20 - I added two 1340/1360 verticals to reduce the negative Delta value of the position and flatten the t + 0 line.

12/23 - I added two 1330/1350 verticals to reduce negative Delta value of the position and flatten the t + 0 line.

12/27 - I took position off with a profit of $2,250 and a total profit from January expiration of $3,690.

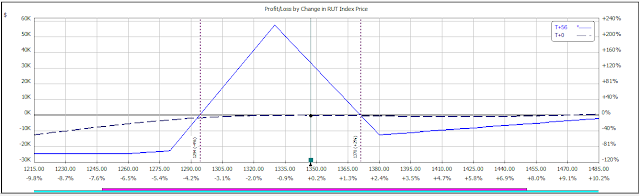

Here is the risk profile graph from the end of the trade: